Entering Real Estate Investing Without Cash or Credit

Investing in real estate without cash or credit may sound impossible, but creative strategies can make it achievable. Through wholesale contracts, owner carryback, rent-to-own agreements, and joint ventures, you gain property control with little to no money down. We’ll delve into actionable techniques for securing and monetizing property rights without banks.

To learn more about investing without cash or credit, visit: best software for real estate investors

Creative Financing Strategies

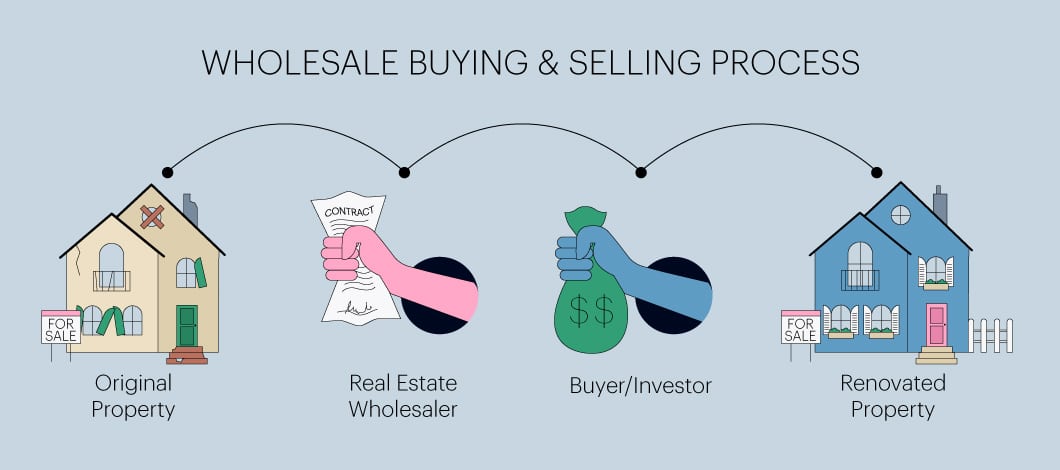

By wholesaling contracts at a discount, you earn assignment fees without a mortgage or credit requirement. This method bypasses the need for large down payments or bank approvals while still providing a steady deal flow. Success relies on mastering lead generation, market analysis, and negotiation skills to match motivated sellers with cash buyers.

Creative Owner-Financing and Lease-Purchase Methods

Seller financing involves structuring a deal where the property owner carries the loan, letting you pay them directly over time. A lease-option contract locks in purchase terms while you build equity through rent credits. Through creative financing, you occupy or contract to buy now while postponing full payment.

Collaborative Deals for No-Cash Investing

By teaming up, you leverage a partner’s cash and credit while offering your negotiation and sourcing expertise. JV contracts outline roles and revenue shares, creating clarity and trust. A well-drafted joint venture agreement with transparent objectives secures smooth collaboration.

Essential Platforms and Insights

Using digital platforms such as CRMs and valuation tools keeps your pipeline organized and efficient. Websites and communities focused on creative financing list off-market and seller-financed properties. Resources like best real estate investing blog WholesalingHousesInfo.com provide step-by-step guidance and community support for leveraging creative financing.

Key Tips for Cash-Free Investing

Rigorous due diligence prevents costly surprises and ensures deal viability. A strong buyer pipeline is crucial for seamless contract transfers. Polished pitch and empathetic listening drive win-win outcomes.

To learn more about alternative real estate investing methods, go to: rei software

Wrapping Up Creative Financing Strategies

Although challenging, zero-down approaches can lead to profitable ventures with the right plan. Combining contract flipping, owner carry, rent-to-own, and partnerships empowers you to expand your portfolio without large down payments. Kick off with market research, draft assignable contracts, and build relationships that support your goals. Through consistent effort, ethical practice, and adaptive learning, you can turn zero-down deals into lasting success.